when to expect unemployment tax break refund texas

Key Things To Know About The Unemployment Tax Break. Currently the average 2020 tax refund is about equal to last years roughly 2800 but every year a sizable number of taxpayers say they are surprised by the amount of their tax refund or tax bill.

Unemployment Tax Refund Will You Get A Refund For This Benefit Marca

This means that you will have to report all the unemployment benefits you receive on your federal tax return at the end of a tax year.

. Tax refund time frames will vary. Get your tax refund up to 5 days early. If you cannot file.

The IRS has announced that it expects to issue more than 90 of refunds to taxpayers in less than 21 days not business. Experts say one of the most likely culprits of a pint-sized refund is that you arent withholding enough from your paychecks for Uncle Sam. As part of the American Rescue Plan unemployed Americans temporarily got a tax break last year.

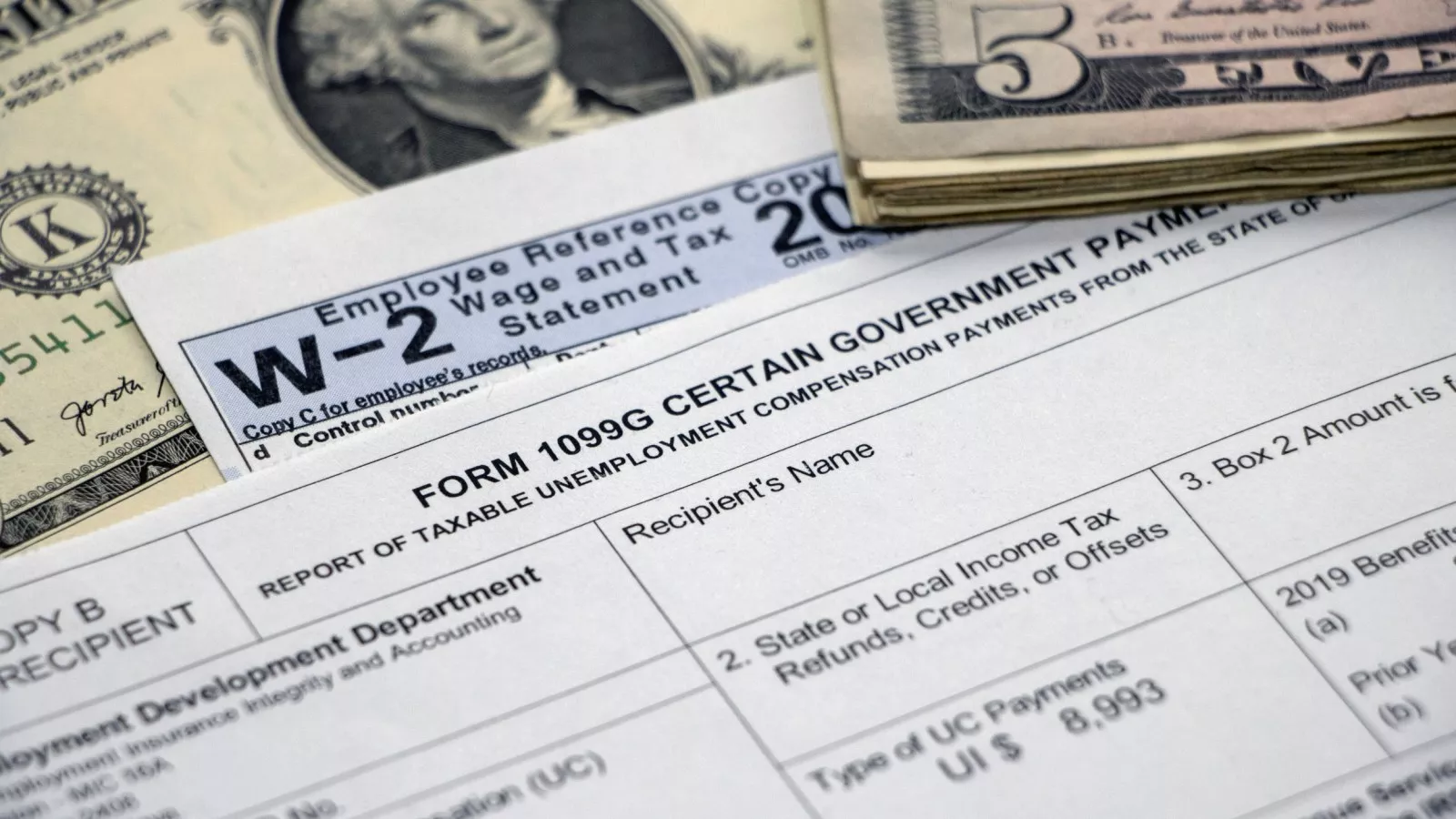

Texas Workforce Commission TWC has mailed the Internal Revenue Service IRS Form 1099-G Certain Government Payments to all claimants who received Unemployment Insurance UI benefits in 2020. The temporary tax break applied only for those with modified adjusted gross incomes of. However this unemployment tax break applied only to 2020 tax returns.

Tax refund time frames will vary. As the federal government manages its on-going and rapidly evolving response to the coronavirus epidemic a variety of solutions including an additional 300 unemployment per week an extension to March 12 2021 for self-employed taxpayers to collect unemployment and extension implementing paid leave for some workers and tax credits for small businesses and. Up to 10200 of unemployment benefits went.

Check the IRS tax tool wheres my refund WMR or IRS2Go mobile app to get the official status of your refund see estimated IRS refund schedule. If you didnt have taxes withheld and most people dont you could be. On the Separation Notice employers must check off one of five reasons for the Jan 18 2022 Annually 9 million in state and federal funding supports the 20000 construction-worker families enrolled in those programs in Connecticut.

This year jobless benefits received in 2021 will be taxable on the 2021 federal income tax return. While federal income taxes were waived on up to 10200 of unemployment benefits for the 2020 tax year theres been nothing to indicate that taxpayers should expect a. Direct Deposit of UI Benefits for new and existing claimants.

The temporary tax break applied only for those with modified adjusted gross incomes of less than 150000 in 2020 and those who also received unemployment benefits last year. So if you collected unemployment benefits in 2021 you should expect 100 of your benefits to be included in your taxable. Last year the American Rescue Plan gave a federal tax break on unemployment benefits.

When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early. Lee the court ruled that there could be a corporate tax essentially saying the structure of business was a justifiably discriminatory criterion for governments to consider when writing tax legislation. First National Bank of Boston v.

As a result any unemployment compensation received in 2020 Apr 18 2021 In New Mexico for example filers are being advised to amend their returns if they were submitted prior to mid-March when the new unemployment tax break became available. The IRS has a Wheres My Refund tool on its website and mobile app IRS2GoYou can use it starting 24 hours after you e-file your return. Fastest tax refund with e-file and direct deposit.

Important Info About Unemployment Tax Break And Refunds The IRS already started sending refunds to taxpayers who received jobless benefits last year and paid taxes on the money. 7 down from 8 in May. Subtract line 33 from line 24 to determine the amount you owe.

Enter the estimated tax penalty. To track your refund youll need to know. This was a unique ruling handed down during a unique time in US history that denied a corporation freedom it sought in the courtroom.

If filing jointly your spouse also needs to enter these. Get your tax refund up to 5 days early. Enter your signature date occupation and IRS identity protection PIN if required.

In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the provision in the American Rescue Plan waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a year. The IRS issues more than 9 out of 10 refunds in less than 21 days. Fastest refund possible.

IRS unemployment refund update. SALEM Oregon corporate tax payments jumped an astonishing 46 last year topping 1 billion for the first time as companies large and small reaped huge profits in the wake of the pandemic. This is for taxpayers who dont expect to get a refund.

Up to 10200 of unemployment benefits went tax-free. How to track and check its state The tax authority is in the process of sending out tax rebates to. When its time to file have your tax refund direct deposited with Credit Karma Money and you could receive your funds up to 5 days early.

The bottom of Form 1040 is used by third-party designee and paid. For Tax Year 2020 taxes filed in 2021 you didnt have to pay federal tax on the first 10200 10200 per person if you are married filing jointly of your unemployment benefits if your adjusted gross income AGI is less than 150000 in 2020. Unlike last year a special tax break doesnt exist for up to 10200 of unemployment benefits.

Fastest tax refund with e-file and direct deposit. Fastest refund possible. However you can ask the Texas Workforce Commission TWC to.

If you file a paper return youll have to wait four weeks and possibly longer given how backed up the IRS is right now before you can check the status of your refund. How to track tax refunds. Unemployment Federal Tax Break.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally issued 430000 refunds on Monday to those who qualify for the unemployment tax break. After some frustration with delays in the rollout many single filers began seeing deposits in their checking accounts starting May 28 with 28 million refunds going out the first week of. It is updated daily overnight and provides the latest processing status of your tax refund.

The IRS issues more than 9 out of 10 refunds in less than 21 days. The return includes a claim filed for an Earned Income Tax Credit or an Additional Child Tax Credit The return includes a Form 8379 Injured Spouse Allocation PDF which could take up to 14 weeks.

Unemployement Benefits Are This Payments Taxable Marca

When Will Irs Send Unemployment Tax Refunds Wfaa Com

Q A The 10 200 Unemployment Tax Break Abip

How To Get A Refund For Taxes On Unemployment Benefits Solid State

![]()

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More

Some 2020 Unemployment Tax Refunds Delayed Until 2022 Irs Says

Irs Sending Out 4 Million Surprise Tax Refunds This Week Kxan Austin

28 Maps That Will Teach You A Damn Thing About Your State For Once Maps Pinterest Humor

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds Cpa Practice Advisor

Covid Bill Changes Tax Rules Midstream How To File An Amended Return

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Key Tax Changes This Year Could Mean Bigger Tax Refunds For Many

28 Maps That Will Teach You A Damn Thing About Your State For Once Maps Pinterest Humor